- Free Consultation: (907) 277-3090 Tap Here to Call Us

Alaska Auto Coverage

Alaska Auto Coverage – Those suffering injuries from a car crash are entitled to recovery. This is true whether you are in a car crash involving multiple cars or a single vehicle. Crashes with a single vehicle may include drivers who are friends, an acquaintance, or even a family member. The bottom line is that auto insurance also covers single vehicle car crashes.

Understanding Alaska Car Insurance

The three types of Alaska Auto Coverage insurance sold to Alaskans intended to help injury victims, include:

- Liability insurance;

- Uninsured and underinsured motorists (often referred to as U/UIM); and

- Medical Payments Coverage (MedPay).

An experienced Alaskan personal injury attorney reviews the driver’s and passenger’s insurance to determine if the policies apply to the crash.

1. Liability (Bodily Injury) Insurance

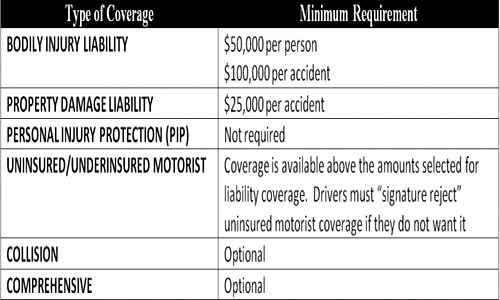

Alaska drivers must maintain at least 50/100 ($50K per person, up to $100K per incident) of liability insurance. This insurance normally covers against “loss from the liability imposed by law for damages that arise from the ownership, maintenance, or use of a designated motor vehicle.” It also normally insures against loss “imposed by law for damages that arise from use by the operator of a motor vehicle not owned by the operator.” In other words, liability insurance covers named insured and all those operating the insured vehicle with the owner’s permission.

2. Uninsured And Underinsured Motorist Coverage

Most drivers also carry uninsured and underinsured motorist coverage. This is a low cost insurance policy that protects drivers hit by people violating the law and not carrying required liability insurance. It can also provide coverage when there is a hit and run accident. Uninsured and underinsured motorist coverage normally extends to all occupants of the insured vehicle, including family members. It is also personal. That means your U/UIM insurance covers you whether you are in your own car or not. Alaskan case law provides that U/UIM insurance even covers people hurt by uninsured/underinsured motorists while “on a pogo stick.”

3. Medical Payments Coverage

Medical Payments refers to coverage included on some car insurance policies that pays medical expenses for all occupants in a vehicle suffering injuries from a crash. The coverage will cover both the person insured and passengers. MedPay covers injuries regardless of who causes the crash. Like U/UIM coverage, MedPay is personal. It normally covers you and your family even while in another person’s car, walking along a street, or on a pogo stick in Australia. It is a low cost insurance option that can be added to most insurance policies.

How Alaska Auto Coverage Helps

If you have suffer injuries following a car crash, even if it was a single car crash, you may be able to receive compensation for your injuries. This can include lost wages, medical bills, and pain and suffering. Having an Alaska personal injury attorney who understands the ins and outs of the Alaska court system is essential. Our attorneys will review your case at no cost.

Understandably, some people are uncomfortable with the thought of suing another family member. Fortunately, Alaskan law provides solutions to that problem. Johnson Law understands the purpose of insurance is to protect your family from catastrophic medical bills, regardless of who is at fault.

Johnson Law knows Alaska and Alaska Auto Coverage Law. Find out how we can help. Call Johnson Law at (907)277-3090 or use our Contact Form to discuss your motor vehicle crash injury case. We are here to serve you.

Johnson Law has been serving Alaska auto injury victims for 30 years. It’s who we are. And while we hope you never need us… We’re here if you do. ~ Doug Johnson

Image Source: Car Insurance List: Car Insurance In Alaska