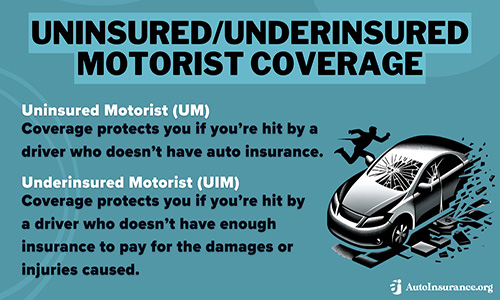

U/UIM Protects Alaskans – Imagine you are in a motor vehicle accident. You are working through a recovery, have a damaged vehicle and need to replace your lost wages. Upon contacting the insurance provider to make a claim for your losses, you discover the driver who struck you either doesn’t have enough insurance or no…

Continue reading ›Articles Posted in Insurance Law

Alaska Liability Insurance typically covers the vehicle on the policy and is not specific to the driver. For example, if you lend your vehicle to someone and they are not insured, your insurance may apply. The same is true if you get into a crash with someone driving a friend or family member’s vehicle without…

Continue reading ›Are You Covered Alaska? Do you have enough auto insurance to protect you in case of a car accident? The summer season is upon us. Summer driving presents a unique set of challenges compared to other seasons. Protect yourself and your loved ones. It’s time for an auto insurance review. Minimum Auto Insurance Requirements In Alaska…

Continue reading ›Auto Insurance – Alaska requires auto insurance, protecting the public from uninsured drivers with both mandatory insurance laws and financial responsibility requirements. The laws provide the Division of Motor Vehicles (DMV) rights to remove drivers from the road for failure to maintain required coverage. Drivers responsible for car crashes must pay property damage and injury…

Continue reading ›Insurance review – 2025 is well underway and it is time to review your auto coverage. It is important to have enough insurance in case something happens. Protect yourself and your loved ones with an insurance coverage review. It is essential to have enough protection after a car accident. Minimum Auto Insurance Requirements In Alaska…

Continue reading ›Home ownership can be both rewarding and challenging. Understanding homeowner insurance can provide relief in stressful situations. People who do not have homeowner insurance on their property risk exposing themselves and property to personal law suits. It is important to make sure that you have enough coverage to protect not only your home but also…

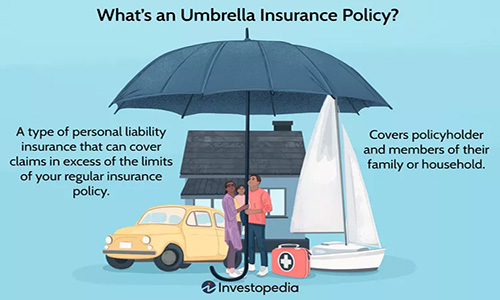

Continue reading ›Umbrella insurance is not common in discussions but is beneficial by adding a layer of protection to meet insurance needs. Umbrella insurance coverage is a secondary layer of insurance and acts like an “umbrella” to protect you and injured parties. The coverage is in addition to other insurance like auto, renter, and homeowner insurances. Umbrella…

Continue reading ›Medical Payments Insurance explained. Many people consider how much auto insurance coverage they may need, balanced against its cost. Yet, most people don’t think much about the different kinds of auto insurance available to them. Most don’t know medical payments insurance is even available. Unfortunately, despite being legally mandatory, many Alaskan drivers fail to carry…

Continue reading ›Uninsured underinsured auto insurance protects you if you are in an accident with someone who does not have enough insurance to cover damages. Further, the coverage you purchase allows peace of mind if you are in any accidents. Nationally, around 13% of drivers do not have insurance. That equates to about one in eight drivers,…

Continue reading ›Liability car insurance is a type of insurance that covers the cost of the other driver’s injuries and property damage if you’re at fault in an accident. Liability car insurance consists of both bodily injury liability and property damage liability insurance. Bodily injury insurance pays for the victim’s lost wages and medical bills. Property damage…

Continue reading ›